Yes, it's small. Yes, it's old and ugly. Yes, the move crimped a wire somewhere so the bathroom lights won't work (we're rewiring it today), but this is ours. All ours. 100% ours. This P.O.J. isn't partially owned by the bank. This bit of land isn't mortgaged. The guys working to get us up and running are under our employ. We're paying them with a check from money we saved and earned and finagled. There's nothing quite like it.

In three years, if all goes according to plan (we actually plan to have the money saved by the end of two years, but we are factoring in the unexpected) we should be moving into our dream house that we planned and built with cash!

The long and the short of it is, we're willing to think outside the box in order to meet our goal of living without the mortgage. We're also willing to put up with a few years of inconvenience and a bit of crowding. Delayed gratification is not something the American culture has been used to, but it is something to think about. Here's some of the creative thinking that we came up with in order to find our particular plan (maybe one of these ideas will spark something for you):

- Move into a cheap, utilities-included apartment, put money from the sale of the house into savings. Sell extra belongings and all lawn and garden equipment at a yard sale, save like crazy.

- Rent out the current home (if a sale is not possible and if the going rents will cover the mortgage plus repairs) and rent a cheap apartment. Sell extra belongings and save like crazy.

- Put a cheap trailer on current land and rent out either it or the mortgaged home. Sell extra belongings and save like crazy.

Other people have thought up better and more creative ways to make life mortgage free. Just google it and see. Now that the big expense is taken care of, we've got to be sure that the little expenses don't start adding up to eat our savings. We'll still be buying cards for the pay as you go phone, living without cable or satellite TV, eating at home (or picnicking), and keeping the wardrobe to a minimum (new stuff is more often "nused"). We don't get to the movies much, but we can play a mean game of Yahtzee!

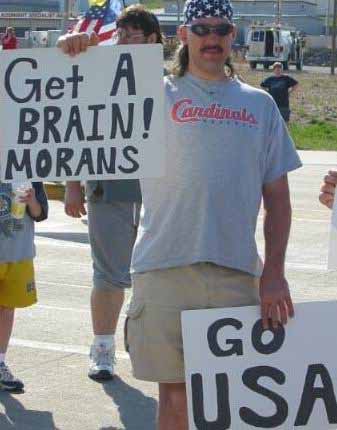

I think I may stick one of these on the side of the ugly yellow trailer. Who cares if the yellows clash?