A short time ago, I posted a little hint about the grand plan in the works to get ourselves out from under a mortgage. With national debt levels hitting the stratosphere, that debt being purchased by a rival world power, banks going belly up, and all the rest of the mess, my Econ 101-honed instincts have tingled like a spidey sense. I'm no Peter Parker of Wall Street, but I can almost see inflation creeping up the side of the Federal Reserve Building.

When and if the dollar goes under, I don't want to be carting buckets full of them to the bank to make monthly payments. Yeah, I know, it can't happen here. We're too big to fail. I know. I know. Zimbabwe used to be the breadbasket of Africa, too. It took only one administration to starve them out. It looks like it'll take at least two over here.

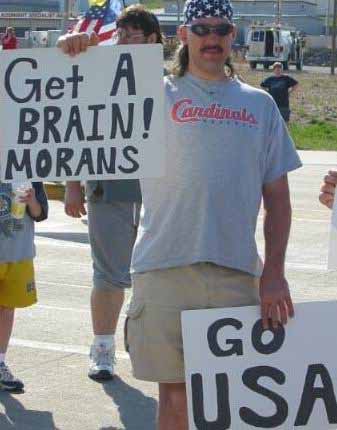

Call me a teabagger, but I'm uneasy. I've been uneasy since the Clinton Administration's fiscal responsibility was tossed out with the bathwater under Bush and has since been merrily and completely mucked up with the mantra "Bush's fault" this go-round.

So, even if I am a dumb hick red state extremist because I say so, I don't like debt. I think too much of it is irresponsible. So now what?

Well, even if I'm wrong about everything, getting our family financially in the black won't hurt, so we're downsizing. We're already pretty fiscally responsible (and pretty Green, too, by the way) by recycling, buying used whenever feasible--yes, even down to the dryer because we only use that when it rains or snows--and not consuming for the sake of stuff. We've taken a few wrong turns here and there, but we've generally been going in the black direction, even when swimming in red ink.

Red Ink--Blue State

As a pigheaded youth I married wrong and then I got sick. That one bad choice and one bad circumstance left me debt riddled and starting over in my early twenties. I moved to the land of golden opportunity and cheap tuition (California in the early 90s) and worked at whatever job I could scrounge up, happily relying on my bachelor's degree that I had also worked hard and paid for (and off) to scrabble into a position that I hated but had benefits. I stood that job as long as I could and as long as it took to save enough money to be able to get my teaching degree while working part time.

As a teacher, I lived frugally. I was taking out the maximum in retirement and living as poorly as a college student on her own dime (again). Some of the other young teachers invested in enviable shoes and great hair. I let mine grow out and clomped around in sensible shoes from Wal-Mart. Yeah, it was good for the soul, I'm sure.

Meanwhile, I was working up a down payment for my first home. Meanerwhile I was courting long distance and planning on marrying the man I should have married in the first place. He had debt issues, too. By the time we tied the knot, we had our 10 % down on a house just shy of $100,000 in the early days of the California market climb. Our house only had two bedrooms and the siding was shot and the realtor really wanted to "work with us" and get us that third bedroom and second bath, but we had my husband's debt load to pay off and no kids to house yet, so we opted for much less than we qualified for. That house was about half of what the banks was begging to "give" us.

Then the real estate bubble hit very hard. In about two years we had doubled our money in equity, so we refinanced and fixed the siding. Two years after that and six years ago this spring, my Econ 101 spidey sense started to tingle, so we sold our house, took our money and ran. California was too expensive to reinvest in and was spending money wildly, so we ran all the way to the Panhandle of Texas where we could pay cash outright for a house.

We were set and we were mortgage free the first time around, but we forgot to factor in some things: neighbors, pushers, and the meth epidemic.

end of Part I

No comments:

Post a Comment